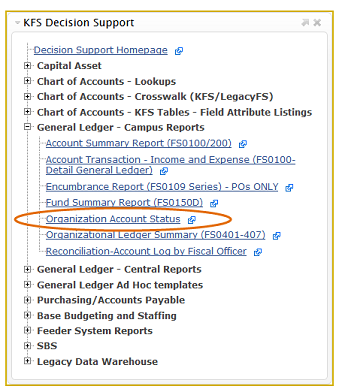

Organization Account Status Report

The Organzation Account Status Report provides users with a quick-glance overview of account status by organization. Keep reading for instructions on how to use the Organization Account Status report.

Running the Report

Running the Report

To run the report, simply enter your Org Number, the Period, and click Run. If you enter the current period, you should be able to validate account Variances against the KFS Balances by Consolidation lookup.

»When reviewing the report as a tool to help prepare for fiscal close, income variances at year-end should be zero, and expense variances should be positive.

Budgeting Income so Variance is Zero

You may recall that one of the fiscal close steps in the old system was to align Income Budget with Actuals so that all income account balances were zero. Although we no longer have income accounts and instead have income object codes, the underlying concept is still an important fiscal close principle.

It is necessary that income Budget and Actuals align at year end to an account variance of zero so that expenditure budgets are neither over—nor under—stated. For instructions how to budget from income object codes (e.g. Rxxx, Sxxx, Txxx, 3900) to expense budget object codes (e.g. 0002, 0003, 0008), see the Budgeting Quick Start Guide.

Downloading to Excel

The Organization Account Status report is designed to enable easy download to Excel. As with all KFS data being exported to Excel, be sure to keep income and expenses separate. KFS values show as positive, regardless of whether they are debit-normal (expenses) or credit-normal (income and fund balance). As a result, it is easy to accidentally sum across accounting categories and inadvertently show an incorrect bottom line. Be sure to calculate the difference.

If you have questions or need help, please contact the KFS Help Desk at kfs@uci.edu or 949-824-7001v.